Nvidia Corporation (NVDA), the leading manufacturer of graphics processing units (GPUs) and a prominent player in the artificial intelligence (AI) chip market, achieved a historic milestone on March 1, 2024.

Nvidia soars to $2 trillion valuation as Dell stocks AI rally stock market value surpassed $2 trillion for the first time, solidifying its position as a tech giant and reflecting the immense potential of the AI revolution.

Dell’s Upbeat Forecast and the AI Boom

This impressive achievement can be credited to several critical elements:

- Dell Technologies‘ Optimistic Outlook: Dell, a major customer of Nvidia’s AI chips used in their high-end servers, released a positive earnings report on February 29, 2024.

The report revealed a significant increase in demand for AI-optimized servers, indicating a thriving market for the technology.

This positive outlook from a major customer instilled confidence in investors and directly impacted Nvidia’s stock price.

- Nvidia’s Dominance in the AI Chip Market: Nvidia is a leader in the design and production of AI chips, specifically Graphics Processing Units (GPUs) optimized for deep learning and other AI workloads.

These powerful chips are crucial for training and deploying AI models across various industries, including healthcare, automotive, and finance.

As the AI market experiences exponential growth, the demand for Nvidia’s products is expected to surge, further propelling the company’s value. - Strong Stock Performance: Nvidia’s stock price has been on a phenomenal journey in recent years. In 2023, the stock price tripled, and in 2024, it has already witnessed a 66% increase as of March 1st.

This continuous upward trend is a testament to investor confidence in Nvidia’s future and its potential to capitalize on the burgeoning AI market.

Market Reactions and Industry Impact

The news of Nvidia’s $2 trillion valuation sent a ripple effect through the tech industry.

- Market Rally: The broader market responded positively to Nvidia’s achievement. Shares of other AI-related companies, such as Super Micro Computer (SMCI), Broadcom (AVGO), Marvell Technology (MRVL), and Advanced Micro Devices (AMD), all experienced significant gains, showcasing the bullish sentiment surrounding the AI sector.

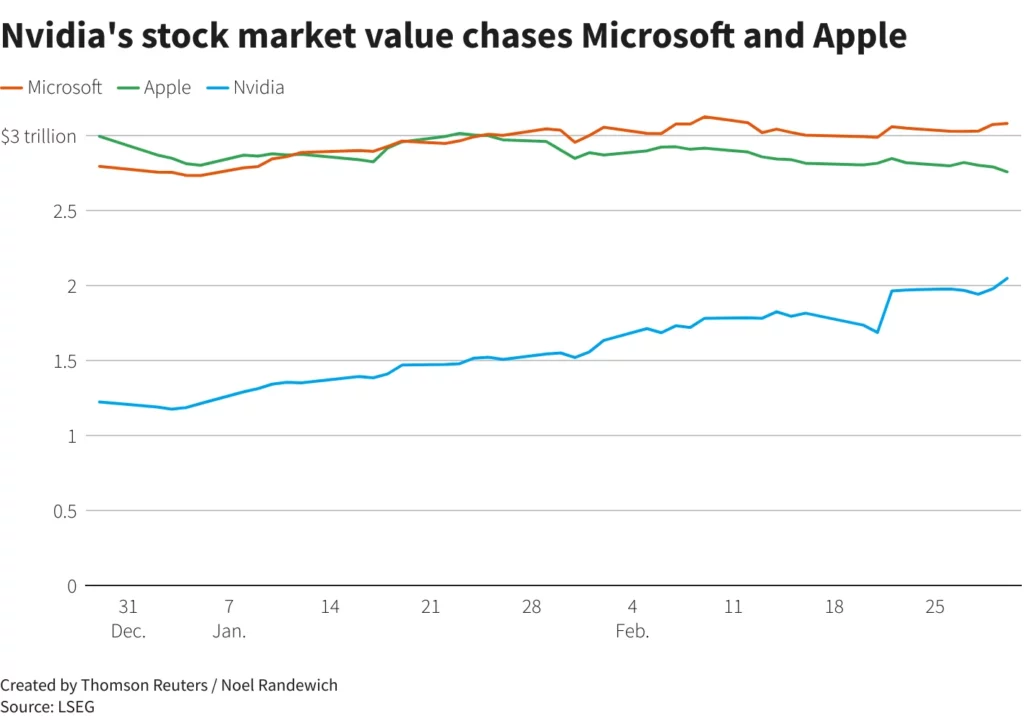

- Nvidia Now the Third Most Valuable Company: With its $2 trillion valuation, Nvidia surpassed Alphabet (GOOG), the parent company of Google, to become the third most valuable company on Wall Street, trailing only Microsoft (MSFT) and Apple (AAPL). This significant milestone highlights Nvidia’s growing influence and importance within the tech landscape.

| Metric | Description | Value |

|---|---|---|

| PHLX Chip Index Gain | YTD gain for the PHLX chip index | 18% |

| Nvidia Market Share (High-End AI Chips) | Market share held by Nvidia | 80% |

| Top Customers (Nvidia AI Chips) | Examples of companies using Nvidia’s AI chips | ChatGPT creator OpenAI, Microsoft, Alphabet, Meta Platforms |

| Daily Trading Volume (Nvidia vs. Tesla) | Average daily trading volume for the past 30 sessions | $36 billion (Nvidia), $21 billion (Tesla) |

| Trading Volume (Nvidia – March 1) | Trading volume on March 1st, 2024 | $38 billion |

| Stock Market Value Increase (February 23) | Single-day increase in market value on February 23rd, 2024 | $277 billion |

| 2024 YTD Stock Price Increase | Year-to-date increase in stock price | 66% |

| 2023 Stock Price Increase | Increase in stock price in 2023 | Tripled |

| Previous Market Value Milestones | Surpassed companies in market value | Amazon and Alphabet |

| Closest Competitor Market Capitalization | Market capitalization of Saudi Aramco | $2.045 trillion |

| Availability of Saudi Aramco Shares | Percentage of publicly traded shares | Less than 2% |

Continued Growth and Innovation

Nvidia’s ascent to the $2 trillion club signifies the immense potential of the AI market and the crucial role Nvidia plays in its development.

The company is expected to continue innovating and expanding its product offerings, further solidifying its position as a leader in the AI revolution.

As the demand for AI solutions continues to grow across various industries, Nvidia is well-positioned to reap the benefits and maintain its impressive trajectory.