Nowadays, handling our money carefully is very important because everything happens quickly. Thanks to technology, we’ve got many helpful tools that make it easier to keep track of what we spend, save money, and get our finances in better shape.

These tools include apps for budgeting that show us where our money goes in real-time, tools that automatically save money for us without much effort and more. We’re going to look at some cool tech tools like budgeting apps, apps that give you cash back and rewards, tools that help you compare prices to find the best deals, digital coupons for discounts, and tools that make saving money super easy.

We’ll see how they work and can be convenient for anyone wanting to save money and businesses looking to attract more customers.

1. Budgeting Apps

Budgeting apps are electronic tools created to assist people in handling their money by monitoring their earnings, spending, and investments. These apps often connect directly to bank accounts, credit cards, and investment accounts to provide a real-time overview of a user’s financial situation.

Here’s a breakdown of how they work, and the benefits they offer.

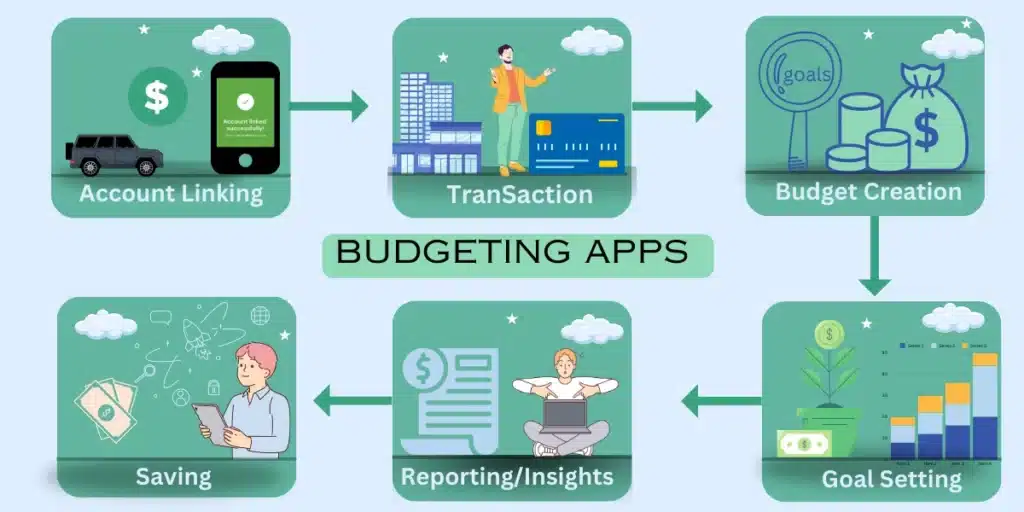

How Budgeting Apps Work

- Account Linking: Users typically begin by linking their financial accounts, including bank accounts, credit cards, and investment accounts. This allows the app to access transaction data in real-time.

- Transaction Categorization: The app automatically categorizes transactions into predefined or custom categories such as groceries, entertainment, or utilities. This helps users understand where their money is going.

- Budget Creation: Users can set spending limits for each category based on their financial goals and income. The app tracks spending against these limits, alerting users when they’re close to exceeding them.

- Goal Setting: Many apps allow users to set financial goals, such as saving for a vacation, paying off debt, or building an emergency fund. They track progress towards these goals over time.

- Reporting and Insights: Budgeting apps provide reports and insights into a user’s financial habits, offering a detailed view of income, spending, savings, and sometimes even investment returns over time.

Benefits of Budgeting Apps

- Improved Financial Awareness: By providing a clear view of where money is going, budgeting apps help users understand their spending habits and identify areas where they can cut back.

- Convenient Financial Management: With all financial information in one place, these apps save time and reduce the hassle of manually tracking expenses or balancing a checkbook.

- Goal Achievement: By setting and tracking financial goals, users can stay motivated and make informed decisions that bring them closer to achieving their financial objectives.

- Spending Alerts: Real-time alerts warn users when they’re close to exceeding their budget, helping prevent overspending.

- Security: Most budgeting apps use bank-level security measures to protect users’ financial data, including encryption and multi-factor authentication.

- Customization: Users can customize categories, budgets, and goals to match their financial situation and priorities.

- Accessibility: With mobile and web versions, users can access their financial data anytime, anywhere, making it easier to make informed financial decisions on the go.

Popular Budgeting Apps

| Budgeting Apps | Key Features |

|---|---|

| Mint | Tracks expenses, income, investments; Offers budgeting tools; Provides credit score updates |

| You Need A Budget (YNAB) | Emphasizes giving every dollar a job; Offers detailed reporting; Provides educational resources |

| PocketGuard | Helps identify savings opportunities; Tracks spending against budget; Monitors subscriptions |

| Goodbudget | Uses envelope budgeting method; Supports sharing budgets with family; Tracks debt repayment |

| Personal Capital | Focuses on wealth management; Tracks investments and retirement savings; Offers budgeting tools |

| EveryDollar | Dave Ramsey’s zero-based budgeting method; Tracks monthly expenses; Provides goal-setting features |

| Wally | Supports location-based tracking; Manages expenses and income; Offers financial insights |

Budgeting apps can be a powerful tool for anyone looking to take control of their finances, offering a range of features designed to facilitate more effective money management. Whether you’re looking to save more, spend less, or simply get a better understanding of your financial situation, there’s likely a budgeting app that can meet your needs.

2. Cashback and Rewards Apps

Cashback and rewards apps are digital platforms designed to incentivize users to make purchases through them or complete certain actions. These apps partner with retailers, brands, and service providers to offer cashback, points, or rewards to users when they shop or fulfill specific tasks. Here’s a detailed look at how these apps work and the benefits they offer.

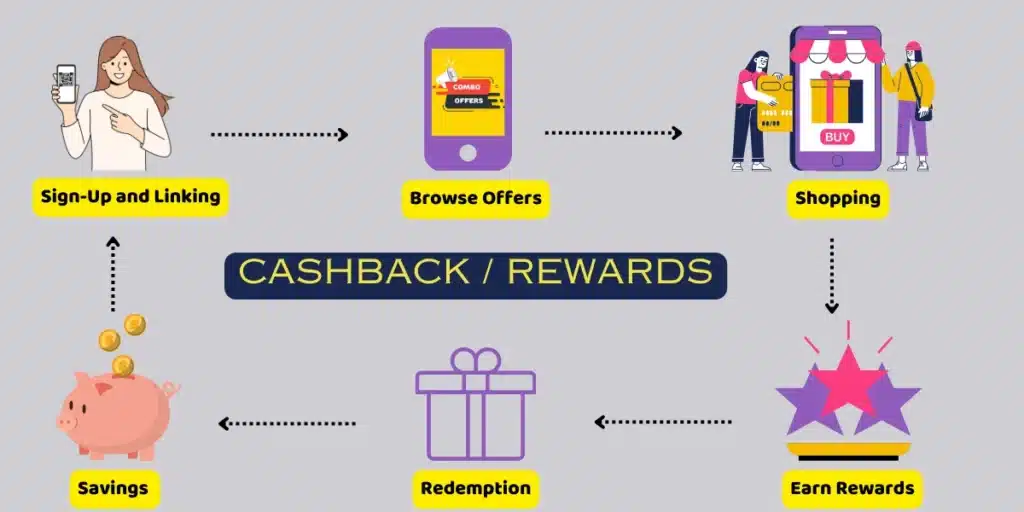

How Cashback and Rewards Apps Work

- Sign-Up and Linking: Users start by signing up for the app and, in some cases, linking credit or debit cards to the app. This allows the app to track purchases made with those cards.

- Browse Offers: These apps display offers from participating retailers, which can range from a percentage of cashback on purchases to points for every dollar spent. Offers can be for online shopping, in-store purchases, or both.

- Shopping: To earn rewards, users shop through the app’s links, use the app while making a purchase in-store, or make purchases with a linked card at participating merchants.

- Earn Rewards: After a purchase is verified, rewards are credited to the user’s account in the form of cashback, points, or other rewards. The verification process can take from a few hours to several days, depending on the retailer and the app.

- Redemption: Once a certain threshold is reached, rewards can be redeemed for various options such as direct bank transfers, gift cards, or merchandise.

Benefits of Cashback and Rewards Apps

- Save Money: The most direct benefit is saving money on purchases you were going to make anyway. Cashback and rewards effectively reduce the cost of purchases.

- Discover Deals: These apps often feature deals, discounts, and promotions that users might not find elsewhere, helping them save even more.

- Easy to Use: With straightforward interfaces, these apps make it easy to earn rewards without significantly altering shopping habits.

- Wide Range of Partners: Many cashback and rewards apps partner with a vast array of retailers, including grocery stores, electronics merchants, and fashion outlets, allowing users to earn rewards on a wide variety of purchases.

- Bonus Rewards: Some apps offer sign-up bonuses, referral bonuses, and special promotions that can significantly increase the amount of rewards earned.

- Customized Offers: Based on shopping history, some apps personalize offers, making them more relevant to the user’s preferences and increasing the chances of earning rewards.

- Increased Purchasing Power: The savings and rewards earned can be put toward future purchases, effectively increasing a user’s purchasing power.

Popular Cashback and Rewards Apps

| Cashback/Rewards App | Key Features |

|---|---|

| Paytm | Offers cashback on recharges, bill payments, and shopping; Integrated wallet and UPI payment system |

| Google Pay (Tez) | Provides cashback and rewards for payments and referrals; Uses UPI for transactions |

| PhonePe | Offers rewards for utility payments, recharges, and online shopping; Built on the UPI platform |

| Amazon Pay | Rewards for shopping on Amazon, bill payments, and recharges; Seamless integration with Amazon |

| CashKaro | Provides cashback and coupons for shopping at partnered retailers; Direct bank transfer for cashback |

| MagicPin | Rewards for shopping and dining out; Offers deals based on location |

| CRED | Rewards for paying credit card bills; Offers exclusive deals and cashback for members |

Cashback and rewards apps offer a practical and straightforward way to get more value out of everyday purchases. Whether it’s earning cashback on groceries, accumulating points for a gift card, or receiving discounts on travel and entertainment.

These apps can significantly enhance the shopping experience. However, users need to shop responsibly and not let the lure of rewards encourage unnecessary spending.

3. Comparison Shopping Tools

Comparison shopping tools are designed to help consumers find the best deals on products and services by comparing prices, features, and reviews across multiple retailers and platforms. These tools can be found as websites, browser extensions, or mobile apps, each offering various functionalities to streamline the shopping process.

Here’s how they generally work and the advantages they offer to savvy shoppers.

How Comparison Shopping Tools Work

- Search and Scan: Users begin by searching for a product or scanning its barcode within the tool. The tool then searches through a database of retailers to find the product.

- Compare Offers: The tool presents a list of retailers who sell the product, along with prices, shipping costs, availability, and sometimes the estimated delivery time. Some tools also show price history graphs.

- Features and Reviews Comparison: Besides price, these tools often compare product features and customer reviews, helping users make more informed decisions based on quality and value.

- Price Alerts: Many comparison shopping tools offer the option to set price alerts for specific products. Users receive notifications when the price drops to or below a target level.

- Coupons and Discounts: Some tools also aggregate and apply coupon codes or highlight special deals and discounts available at various retailers.

- Direct Purchase or Redirect: Users can often make purchases directly through the tool or are redirected to the retailer’s website to complete their purchase.

Benefits of Comparison Shopping Tools

- Save Money: The primary benefit is the potential for significant savings. By comparing prices across multiple retailers, users can ensure they are getting the best deal available.

- Save Time: These tools eliminate the need to visit multiple websites or stores to compare prices manually, making the shopping process more efficient.

- Informed Decisions: With access to comprehensive product information, reviews, and price history, users can make more informed purchasing decisions, avoiding impulse buys and buyer’s remorse.

- Price Alerts: The ability to set price alerts means that shoppers don’t have to constantly check for price drops. They can wait and buy at the best possible time.

- Access to Coupons and Deals: Users benefit from built-in features that find and apply coupons or highlight deals, which might not be readily apparent when shopping directly through a retailer.

- Convenience: Comparison shopping tools are designed for ease of use, whether on a desktop or mobile device, allowing users to shop smartly from anywhere.

- Marketplace Transparency: These tools promote transparency in the marketplace by making pricing and product information more accessible, forcing retailers to be more competitive.

Popular Comparison Shopping Tools

| Comparison Shopping Tool | Key Features |

|---|---|

| MySmartPrice | Offers price comparison across various online retailers; Includes deals, coupons, and product reviews. |

| PriceDekho | Compares prices for a wide range of products across different e-commerce platforms in India. |

| CompareRaja | Provides price comparison, product specifications, and reviews; Covers electronics, appliances, and more. |

| Smartprix | Offers price comparison for electronics, mobile phones, and gadgets; Provides deal alerts and product reviews. |

| BuyHatke | Provides price comparison, price drop alerts, and coupons; Features a browser extension for automatic price comparison. |

| 91mobiles | Specializes in mobile phone comparisons; Offers detailed specs, reviews, and price comparisons. |

| ShopMania | Compares prices for electronics, home appliances, and more; Includes product reviews and merchant ratings. |

Comparison shopping tools empower consumers to take control of their purchasing decisions, ensuring they pay fair prices for products and services. By leveraging technology to compare prices and features efficiently.

Shoppers can enjoy savings, convenience, and confidence in their purchases. Whether planning a significant purchase or looking for everyday items, these tools can make a notable difference in how consumers shop and spend.

4. Digital Coupons and Promo Codes

Digital coupons and promo codes have become an essential part of online shopping, offering discounts and deals that are easily applied at checkout. These digital discounts can be found on retailer websites, through promotional emails, on coupon websites, or via mobile apps.

Here’s a closer look at how they work and the benefits they offer both consumers and businesses.

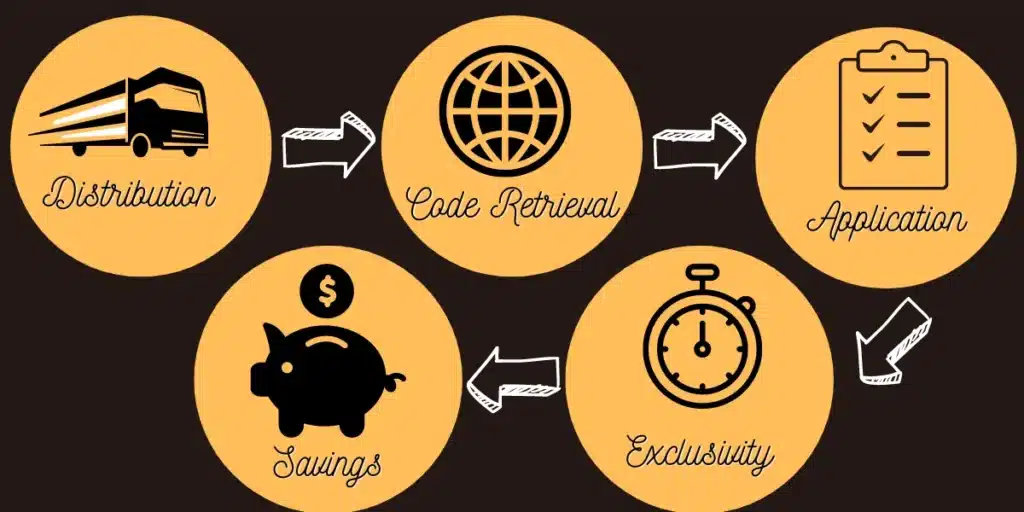

How Digital Coupons and Promo Codes Work

- Distribution: Retailers and brands distribute digital coupons and promo codes through various channels, including their websites, email newsletters, social media, affiliate marketers, and dedicated coupon websites.

- Code Retrieval: Shoppers can find these codes by subscribing to newsletters, visiting coupon websites, or using apps designed to aggregate and provide notifications for the latest deals.

- Application: During the online checkout process, there’s usually a field where shoppers can enter a promo code. Once applied, the discount is automatically calculated and reflected in the total purchase price.

- Exclusivity and Conditions: Some coupons and codes are exclusive to certain customers (e.g., first-time customers or members) and may come with conditions like minimum spend requirements, specific product eligibility, or expiration dates.

Benefits of Digital Coupons and Promo Codes

For Consumers

- Cost Savings: The most apparent benefit is the direct cost savings on purchases. Even modest discounts can add up over time.

- Convenience: Unlike traditional paper coupons, digital coupons are easily accessible from smartphones or computers, making them more convenient to collect, store, and use.

- Increased Purchasing Power: Discounts may enable consumers to buy higher-quality items or more items for the same amount of money, thus increasing their purchasing power.

- Discovery of New Products and Brands: Promotional offers can encourage shoppers to try products or brands they wouldn’t normally consider, broadening their shopping horizons.

Popular Platforms for Consumers

| Platform | Key Features |

|---|---|

| RetailMeNot | Offers a wide variety of digital coupons, promo codes, and cashback offers for thousands of stores. |

| Coupons.com | Provides printable coupons and digital promo codes, mainly for groceries and household items. |

| Groupon | Specializes in local deals and discounts for services, experiences, and goods, along with promo codes for retail. |

| Honey | Browser extension that automatically applies the best coupon codes at checkout on various websites. |

| Slickdeals | Community-driven deals site offering user-submitted coupons and promo codes, along with deal alerts. |

For Businesses

- Increased Traffic and Sales: Offering digital coupons can attract more visitors to a website or online store, potentially increasing sales and revenue.

- Customer Loyalty: Coupons and promo codes can help build customer loyalty by rewarding repeat customers with exclusive deals.

- Data Collection: When consumers use digital coupons, businesses can track their shopping behavior, preferences, and responsiveness to certain promotions, aiding in personalized marketing efforts.

- Clear Inventory: Promo codes are an effective tool for clearing out old or excess inventory without resorting to large-scale markdowns that might devalue the brand.

- Measurable Results: The impact of digital coupons and promo codes on sales and customer engagement can be directly measured, allowing businesses to refine their marketing strategies.

Popular Platforms for Businesses

| Platform | Key Features |

|---|---|

| Voucherify | A versatile coupon management platform that enables businesses to create, distribute, and track personalized coupon campaigns. |

| Yotpo | Provides integrated solutions for customer reviews, loyalty programs, and referral marketing, including promo codes. |

| Coupon Tools | Offers a digital coupon platform for businesses to create and distribute mobile coupons and vouchers. |

| Woobox | A marketing platform that allows businesses to create and manage coupons, contests, and social media campaigns. |

| Coupontools | Specializes in mobile coupon creation and distribution, providing businesses with a suite of tools for digital promotions. |

Digital coupons and promo codes represent a win-win for consumers and businesses alike. Consumers enjoy savings and the convenience of shopping from anywhere, while businesses can boost sales, clear inventory, and gather valuable customer insights.

As the digital marketplace continues to evolve, the use of digital discounts is likely to grow, further enhancing the online shopping experience. Learn how to leverage ChatGPT for small business customer service.

5. Automated Savings Tools

Automated savings tools are digital platforms designed to help individuals effortlessly save money by automating the process. These tools can take various forms, including apps, bank account features, or standalone software, each employing different strategies to facilitate savings.

Here’s an overview of how these tools work and the benefits they offer to users.

How Automated Savings Tools Work

- Linking Accounts: Users typically start by linking their checking accounts or primary bank accounts to the automated savings tool. This allows the tool to analyze spending patterns and identify savings opportunities.

- Setting Goals: Many tools encourage users to set savings goals, such as an emergency fund, vacation, or down payment for a home. The tool then calculates how much needs to be saved regularly to meet these goals.

- Automatic Transfers: Based on the user’s income and spending patterns, the tool automatically transfers funds from a checking account to a savings account. These transfers can be scheduled regularly (e.g., weekly, bi-weekly) or triggered by specific conditions (e.g., rounding up purchases to the nearest dollar).

- Rules and Triggers: Users can set custom rules for saving, such as saving a certain percentage of their income or rounding up all transactions to the nearest dollar and saving the difference.

- Monitoring and Adjustments: The tool monitors the user’s financial situation and adjusts saving activities accordingly. For example, if the tool detects a lower-than-usual balance in the checking account, it might temporarily reduce the saving rate to avoid overdrafts.

Benefits of Automated Savings Tools

For Users

- Effortless Saving: The primary benefit is the automation of the saving process, making it effortless for users to save without having to think about it regularly.

- Achieve Financial Goals: By setting and automatically contributing towards specific financial goals, users are more likely to achieve them on time.

- Adaptability: These tools can adjust saving amounts based on the user’s current financial situation, ensuring that saving doesn’t interfere with the ability to cover everyday expenses.

- Financial Discipline: Automating savings helps build financial discipline by making saving a regular part of the user’s financial routine.

- Encourages Saving: For those who find it challenging to save regularly, these tools make it easier to start and maintain a saving habit.

For Financial Institutions

- Customer Engagement: Offering automated savings tools can enhance customer engagement and satisfaction by providing valuable services that help users meet their financial goals.

- Increased Deposits: Automated savings can lead to an increase in deposits, benefiting banks and financial institutions with more assets under management.

- Data Insights: Financial institutions can gain insights into customer spending and saving habits, enabling them to tailor other financial products and services more effectively.

Automated savings tools represent a significant advancement in personal finance management, leveraging technology to simplify the savings process.

By removing barriers to saving, such tools can help users build a solid financial foundation, reduce financial stress, and achieve their long-term financial objectives more efficiently.

Conclusion

Using technology to manage our money has completely changed how we look after our financial health. Now, we can use budgeting apps to get a clearer idea of how we spend our money, apps that offer us cash back and rewards to save on items we purchase, tools to compare prices and get the best deals, digital coupons for instant discounts, and tools that automatically save money for us, making it easier to grow our savings.

All these tech tools help us make smarter choices with our money, and encourage us to be more careful and informed about our finances. As we keep dealing with the challenges of managing our daily spending and savings, using these tools can help us improve our financial situation and make sure we’re secure in the future.