The thing has changed how we do transactions locally, making it super easy and quick to transfer money. It just feels so simple and gets the job done right away! Within our national borders, UPI has gained immense popularity, evoking a sense of convenience and efficiency. The capability to make international payments has emerged as a real game-changer, stirring excitement for individuals and businesses involved in global transactions. In this comprehensive guide, we will warmly guide you through the steps to make international payments, ensuring a connected and positive financial experience.

Understanding International UPI Payments

Unlike domestic UPI transactions, international UPI payments involve additional steps and considerations. The process generally requires the use of a multi-currency wallet or a specialized international UPI platform that supports cross-border transactions.

Steps to Activate and Make International UPI Payments

Choose a Platform

Select a UPI platform that supports international transactions. Various platforms are available for sending money across countries. Here are some third-party apps.

Here, we are doing this process through the PhonePe app, if you want, you can also make international payments through any of these other apps.

Firstly, You need to have a PhonePe account if you don’t have click on the link and install it.

Create an Account on PhonePe

- Sign up for your account on PhonePe. You will need to provide relevant information such as your name, email address, and a valid identification document, depending on the platform’s requirements.

Verify Your Identity

- Complete the identity verification process as mandated by the platform. This may involve submitting additional documents.

Link Your Bank Account

- Connect your bank account or credit/debit card to the international UPI platform.

Activate International UPI

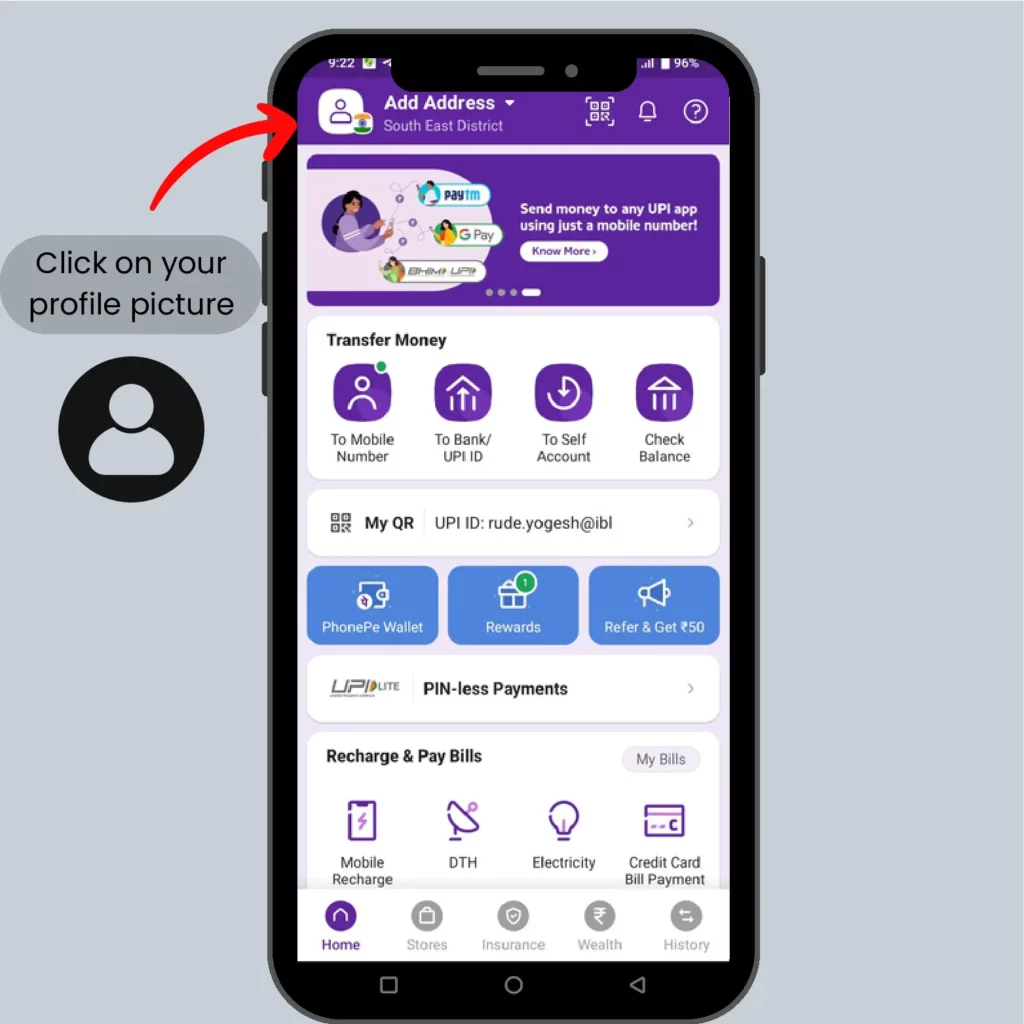

- Click on your profile picture on the left side of the corner

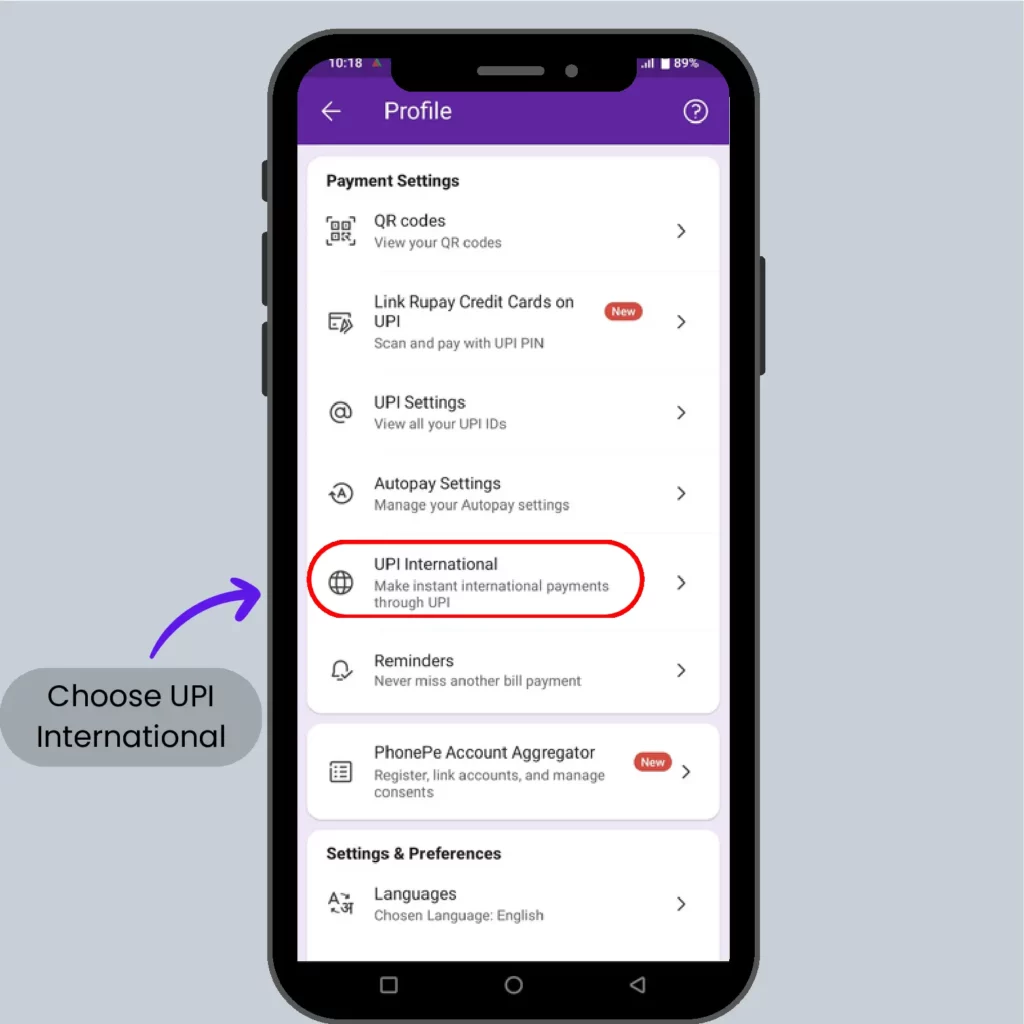

- Choose UPI International

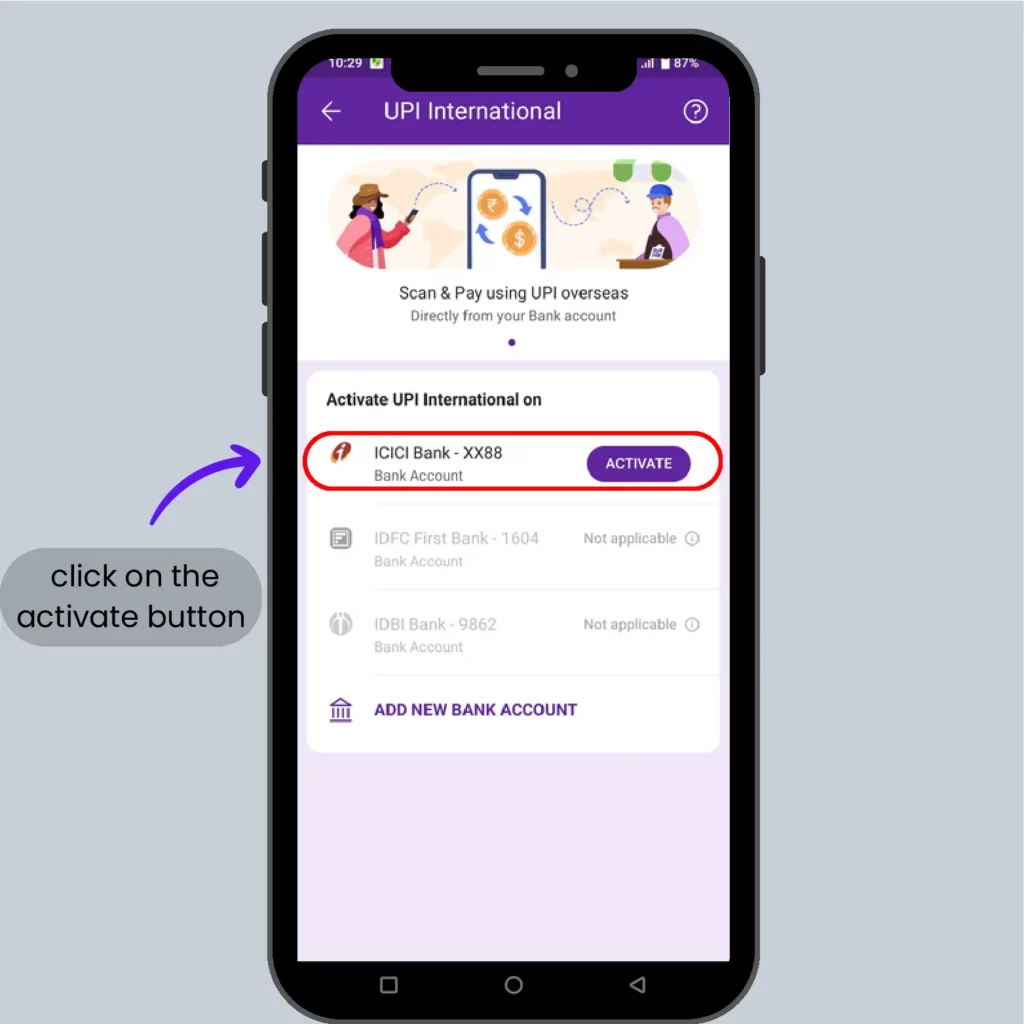

- To activate UPI International service click on the activate button.

- Phonepe will ask you for your PIN, enter the PIN, and.

- Congratulations you have successfully registered International UPI.

- Scan the PhonePe merchant’s QR code.

- Enter the amount.

- Tap Pay.

- Enter your UPI PIN.

- You have successfully transferred to the receiver account.

Note: The total amount payable will be displayed in both local and Indian currency

Considerations and Tips

Exchange Rates: Be mindful of the exchange rates offered by the platform. Compare rates with other providers to ensure you get a competitive deal.

Charges: Understand the fee structure associated with international UPI transactions. Some platforms may charge a percentage of the transaction amount or a flat fee.

Security: Choose a reputable platform with robust security measures to safeguard your financial information and transactions.

Regulatory Compliance: Ensure that the platform complies with international regulations to prevent any legal complications.

Recipient Information: Double-check the recipient’s details to avoid any errors that could lead to payment delays or issues.

Conclusion

Exploring international UPI payments creates numerous opportunities for individuals and businesses to navigate transactions across borders, aligning with human considerations and needs. Just follow these steps and think about the important stuff, and you can grasp the handiness and smoothness of UPI, making money flow easily across borders. For the latest updates on UPI changes in 2024, check out 2024 UPI Changes. This not only connects the world but also simply mixes finances.